The German Book Market in 2021

‘The Return of Events Is Essential for the Industry’

The top-line assessment from the German book publishing industry announced today in a news conference from the Börsenverein des Deutschen Buchhandels, Germany’s publishers and booksellers association mentions “a consumer slump” as well as the effects of the still-ongoing coronavirus COVID-19 pandemic and a paper supply crisis.

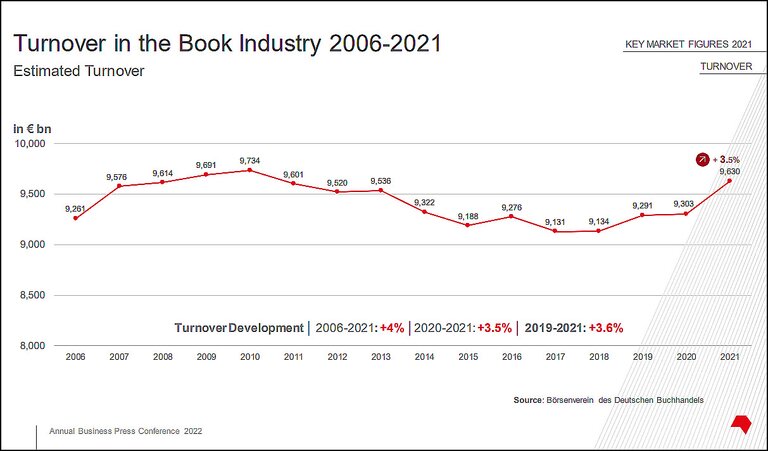

“The total turnover of the industry rose by 3.5 percent in 2021,” says today’s report from the Börsenverein. “Nevertheless, the past two years have been very challenging for the industry from an economic perspective.

“It’s now facing new hurdles in procurement bottlenecks, increasing cost pressure, and the effects of the Russian attack on Ukraine.

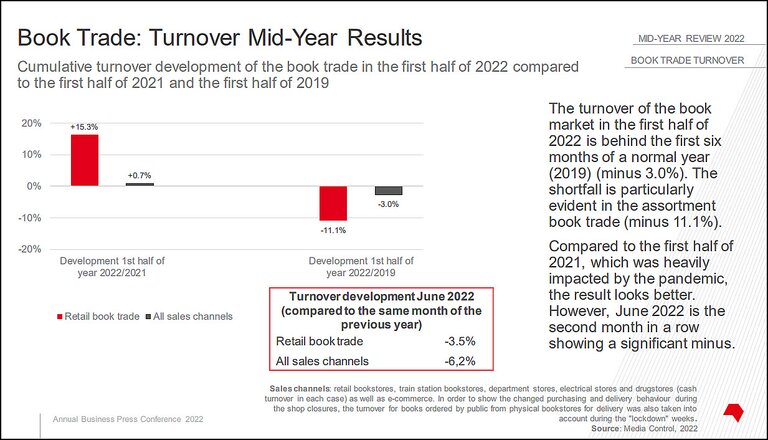

“This is already reflected in the half-year figures for 2022. After the first six months, the sales shortfall in the local book trade amounts to 11.1 percent in the local book trade, and to 3 percent across all sales channels including online retail, as compared to 2019.

As the Börsenverein’s team is careful to point out, a rather specific sense of unease accompanies the current-year six-month figures—that 11.1-percent sales lag—because experience has shown that the more diversity-driven content can be what’s hobbled in such a scenario.

“In times of tight budgets” the report tells us, “publishers also tend to focus on ‘safe’ titles. The offbeat, the courageous, the innovative then sometimes miss out.”

And this feeds into one of the more prominently expressed observations of the day’s news conference: “The return of events where people can meet face to-face, like Frankfurter Buchmesse [October 19-23], is essential for the industry; such events increase public awareness of books and are indispensable for the business and networks in the industry.”

A new all-time low for consumer confidence

Data: A New All-Time Low in Consumer Confidence

The German market research company GfK—Gesellschaft für Konsumforschung, or Association for Consumer Research—in June identified what’s being described as “a new all-time low for consumer confidence” in the German market.

Retail traffic in city centers is currently still significantly below the pre-coronavirus levels, according to the research. In addition, companies in the book industry are experiencing significant price increases for energy, raw materials, and staff wages.

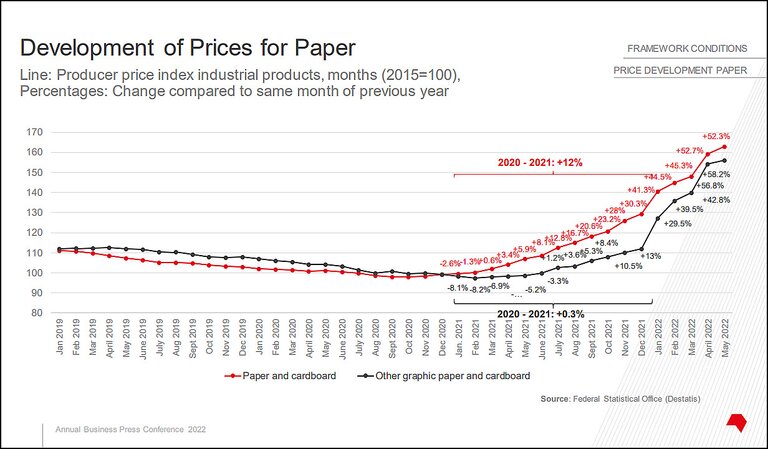

According to the German Federal Statistical Office, printing costs for books in May rose by 21.1 percent compared to the same month in 2021. In December, it was still 3.8 percent, demonstrating a precipitous drop in the months between December 2021 and May of this year.

The price of graphic paper and cardboard is also rising and was 58.2 percent higher in May 2022 than in the same month of the previous year.

Reflecting the urgent stress indicators from the GfK research, vom Cleff has called for fast government action, saying, “In the face of an economic crisis of such historic magnitude, we call upon our politicians to support the affected industries.

“For the book industry, for example, the reduction of VAT on books to zero percent with a full deduction of input tax, which has now been made possible through EU legislation, would be a great help.

“Structural support is also required to maintain diversity in the book market. In addition, we need programs for the revitalization of city centers, which are well thought-out and well-funded, such as those currently being called for by the German Cultural Council together with an alliance of associations. As cultural centers and ‘third places’ par excellence, bookstores can play an important role in revitalizing city centers.”

Details of Germany’s 2021 Book Industry Report

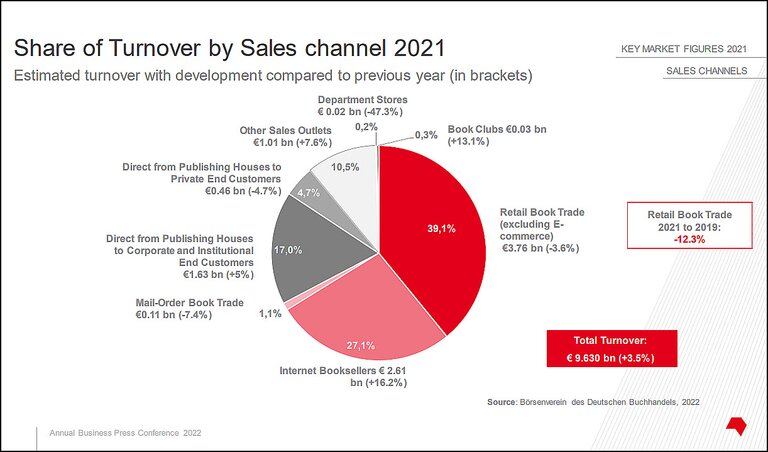

The industry generated a total turnover of €9.63 billion in 2021, while in 2020, the figure was €9.3 billion.

- Physical bookstores remained the largest sales channel for books with €3.76 billion and a share of 39.1 percent. However, this business was 3.6 percent behind the previous year, and even 12.3 percent behind 2019

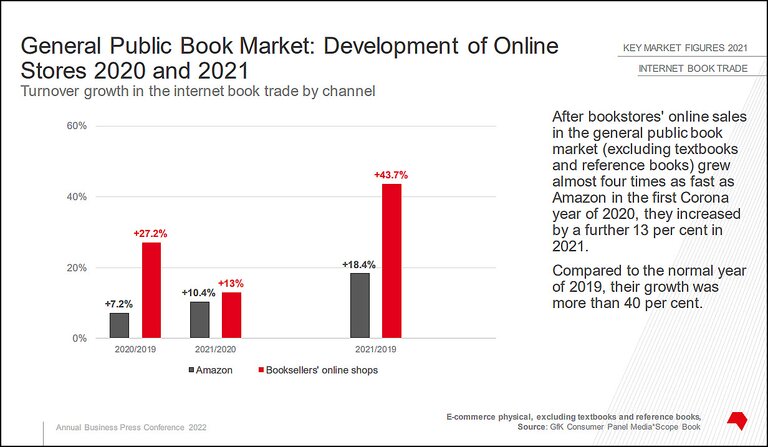

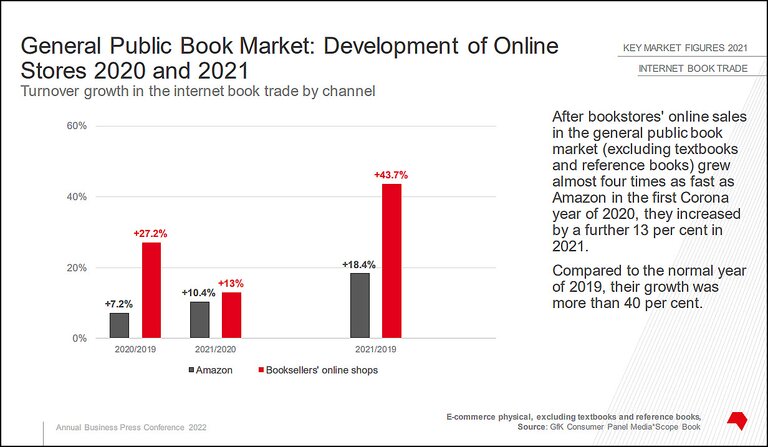

- Internet book trade continues to grow, with bookstores’ online shops accounting for about half of this: turnover increased by 16.2 percent from €2.24 billion to €2.61 billion in 2021. The turnover share of the Internet book trade in the total market was thus 27.1 percent in 2021, as opposed to 24.1 percent in 2020

- A look at the general public book market—excluding textbooks and reference books—shows that local bookstores made the most significant gains in online business during the first two years of the still-ongoing pandemic. At 43.7 percent, the growth rate for bookseller’s online shops in 2021 was more than twice as high as Amazon’s 18.4 percent compared to pre-coronavirus levels.

The positive sales results in 2021 are reflected in almost all general public product groups.

- Fiction recorded the largest growth of 5.7 percent compared to the previous year. With a turnover share of 31.9 percent, it remains the most important product group

- Books for children and young adults (+4.4 percent), nonfiction (+3 percent), and companions (+0.5 per cent) also increased

- Travel books recorded a small minus of 0.4 percent

The prominence of backlist seen in some world markets did not hold sway in 2021 in Germany. Last year’s book purchases were more concentrated on bestsellers: while overall sales fell by 3 percent, sales of the top titles on the bestseller list rose significantly. Overall, sales of the Top 10 titles increased by 23.6 percent. In the fiction category, it was almost 40 percent.

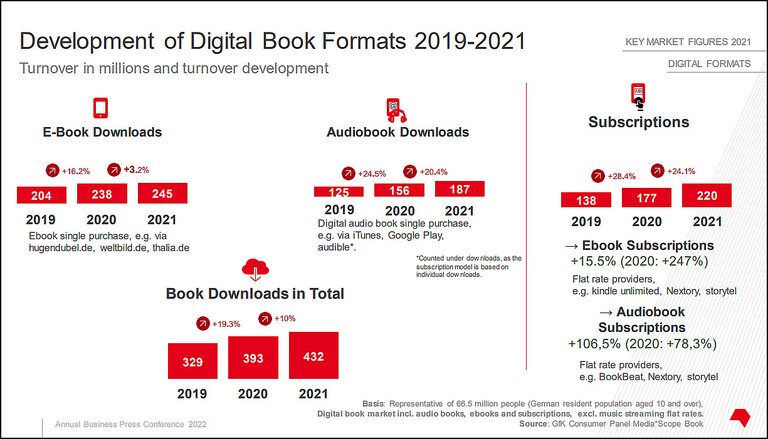

Digital Formats: Audiobooks Up 20.4 Percent, Ebooks 3.2 Percent

Demand for digital book formats continued to rise again in the second pandemic year, marked by lockdowns and store closures.

- The market for audiobook downloads grew particularly strongly with a plus of 20.4 percent

- The number of subscriptions—flat-rate offers for ebooks and audiobooks—also posted large increases of 24.1 percent

- Sales of ebook downloads on the general public market—excluding textbooks and reference books—rose only slightly by 3.2 percent in the second pandemic year; their share of sales on the general public market was 5.7 percent, while in 2020 they were +16.2 percent to 5.8 percent

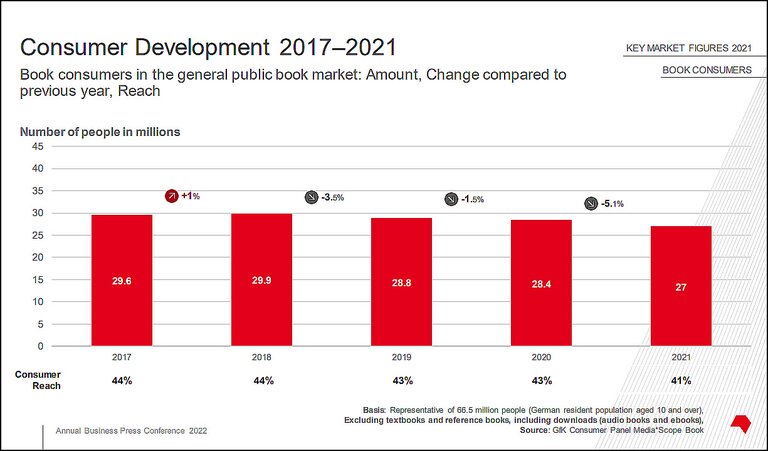

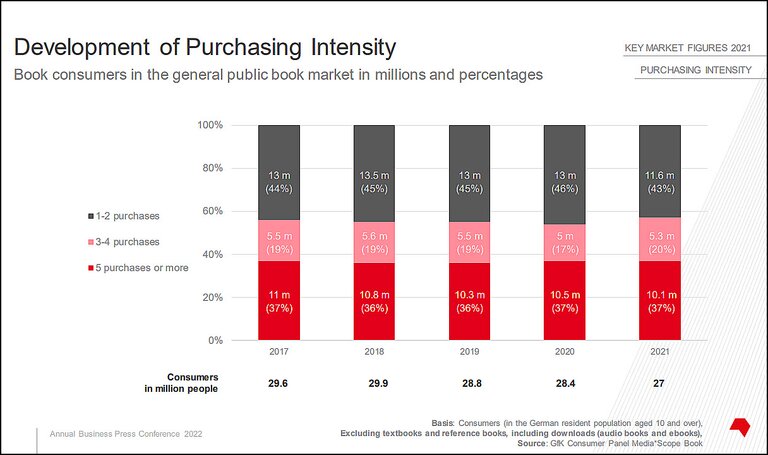

Number of Book Buyers: Down by 5.1 Percent

Perhaps among the most significant of these observations, the number of people buying books continued to decline in 2021.

- Around 27 million people bought books in Germany in 2021, 5.1 percent fewer than in the previous year. Those who did buy books, however, intensified their purchases.

- The 10- to 19-year-olds increased their spending the most during the pandemic period so far, namely by 26.9 percent between 2019 and 2021

In addition, the average purchase frequency among the youngest group of buyers increased significantly from an average of 6.8 books in 2019 to 8 books in 2021.

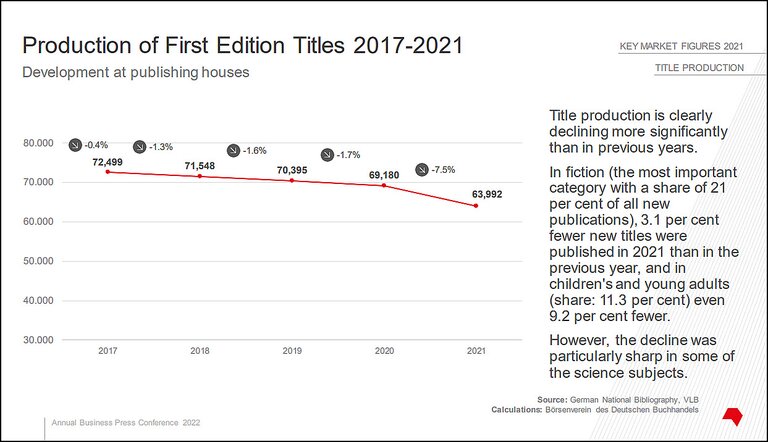

Frontlist Releases: Down by 7.5 Percent

The number of first editions by publishers fell more significantly in 2021 than in previous years.

- It decreased from 69,180 in 2020 to now 63,992 titles, a negative 7.5 percent. The decline was particularly strong in some science fields

- There was also an above-average drop in children’s and young adult (YA) books, at negative 9.2 percent, and a lesser drop of 3.1 percent in fiction titles

What will be interesting about this in some of our world book markets beyond Germany—the United States’ in particular—is that it reflects a lagging share of the market for frontlist titles, first editions as they’re called here. After years of wishing aloud that backlist would sell more robustly, the pandemic years have seemed to enrich interest in backlist, possibly at the expense of frontlist sales.

On the other hand, when it can be demonstrated that there’s not as much inventory coming into the frontlist as before, a reduced trade in those first editions makes sense. In Germany, it appears that this could easily be a factor with its newly released fiction titles and even those in children’s and YA output showing smaller numbers.

When Publishing Perspectives spoke with students this week at New York University Center for Publishing’s Summer Institute, we asked how many of them during the pandemic years had found themselves consciously reading more backlist than before. As much as a third of this group of roughly 75 students said that they had, indeed, chosen backlist titles consciously and purposefully, rather than looking for the newest releases.

While its not clear yet which of the many forces at work in our international markets may be slowing frontlist sales (where that phenomenon is observed), it remains something coming under careful study for many publishers and advisers in the industry.

This article was originally written and published by Publishing Perspectives at https://publishingperspectives.com/2022/07/the-german-market-in-2021-turnover-up-3-5-percent/